That same year FNMA went public on New York and Pacific Exchanges. those not insured by the FHA, VA, or FmHA, and created the Federal Home Loan Mortgage Corporation (FHLMC), colloquially known as Freddie Mac, to compete with Fannie Mae and thus facilitate a more robust and efficient secondary mortgage market.

In 1970, the federal government authorized Fannie Mae to purchase conventional loans, i.e.

#Fannie mae hobby farm full

As such, Ginnie Mae is the only home-loan agency explicitly backed by the full faith and credit of the United States government. Ginnie Mae, which remained a government organization, guarantees FHA-insured mortgage loans as well as Veterans Administration (VA) and Farmers Home Administration (FmHA) insured mortgages. In the 1968 change, arising from the Housing and Urban Development Act of 1968, Fannie Mae's predecessor (also called Fannie Mae) was split into the current Fannie Mae and the Government National Mortgage Association ("Ginnie Mae"). In 1954, an amendment known as the Federal National Mortgage Association Charter Act made Fannie Mae into "mixed-ownership corporation", meaning that federal government held the preferred stock while private investors held the common stock in 1968 it converted to a privately held corporation, to remove its activity and debt from the federal budget. įannie Mae was acquired by the Housing and Home Finance Agency from the Federal Loan Agency as a constituent unit in 1950. Other considerations may have motivated the New Deal focus on the housing market: about a third of the nation's unemployed were in the building trade, and the government had a vested interest in getting them back to work by giving them homes to build. For the first thirty years following its inception, Fannie Mae held a monopoly over the secondary mortgage market. Fannie Mae created a liquid secondary mortgage market and thereby made it possible for banks and other loan originators to issue more housing loans, primarily by buying Federal Housing Administration (FHA) insured mortgages. Originally chartered as the National Mortgage Association of Washington, the organization's explicit purpose was to provide local banks with federal money to finance home loans in an attempt to raise levels of home ownership and the availability of affordable housing. Congress in 1938 by amendments to the National Housing Act as part of Franklin Delano Roosevelt's New Deal. To address this, Fannie Mae was established by the U.S. This resulted in foreclosures in which nearly 25% of America's homeowners lost their homes to banks. By 1933, an estimated 20 to 25% of the nation's outstanding mortgage debt was in default. housing market, as people lost their jobs and were unable to make payments. Historically, most housing loans in the early 1900s in the United States were short term mortgage loans with balloon payments.

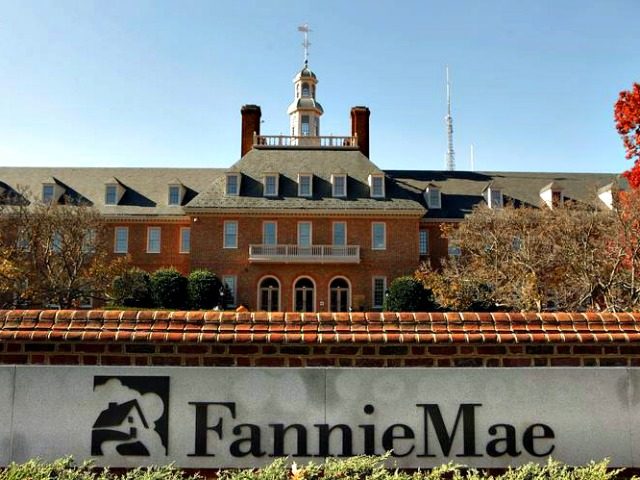

History Background and early decades A view, from the southwest, of the Federal National Mortgage Association's (Fannie Mae's) Reston, Virginia facility In 2023, Fannie Mae was ranked number 28 on the Fortune 500 rankings of the largest United States corporations by total revenue.

Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). The Federal National Mortgage Association ( FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company.

0 kommentar(er)

0 kommentar(er)